If you need to chat about your finances, you can reach out to your personal bookkeeping team by message or schedule a phone call all within the Bench platform. You even get access to our tax professionals, who can advise you on minimizing your tax bill. A provider built specifically to meet the needs of smaller organizations, Bench Accounting’s outsourced bookkeeping services can completely replace your current process or software tools.

But while most professionals know QuickBooks as a software-only solution, Intuit’s financial forerunner’s offerings are much broader than that. If you need in-house support but can’t afford to hire a bookkeeper full-time, consider hiring one part-time, and increasing their hours as needed. Some businesses also bring in a multi step income statement part-time bookkeeper but assign them extra administrative tasks in order to create one full-time position.

- And the Executive plan, which is built for larger companies that need CFO services, has custom pricing.

- Smaller organizations may struggle to find the time, the expertise and the tools necessary to keep pace with the perpetual fluctuations inherent in doing business.

- Result in more accurate financial records and reporting while reducing errors.

- Some companies charge by the number of accounts you need them to manage, while other companies charge based on your company’s monthly expenses.

800Accountant: Best for small-business taxes

But there’s more than one virtual accounting company in the world, and solutions range from what is certified payroll 2021 requirements and faq on-demand CFO services to simple pay-by-the-hour book balancing. Below, we review the best virtual and outsourced accounting services for small-business owners like you. Simply put, outsourcing is the action of one company hiring another company to perform its specific internal services. When you consider external accounting or bookkeeping services, you want to hire an outside service to fulfill all of your small business accounting tasks and finance responsibilities.

Outsourced Bookkeeping: Everything You Need to Know (

Bench makes it possible to undo that kind of damage and get you back to a state of confident accuracy in short order. When your business needs outgrow the solutions we’ve covered, it probably means you need to grow your accounting department and employ an in-house bookkeeper. Thanks to the numerous options out there, you can find the solution that works best for your specific needs and preferences. Whether you have a small, growing, or large business, you can find a dedicated bookkeeper for all types of companies.

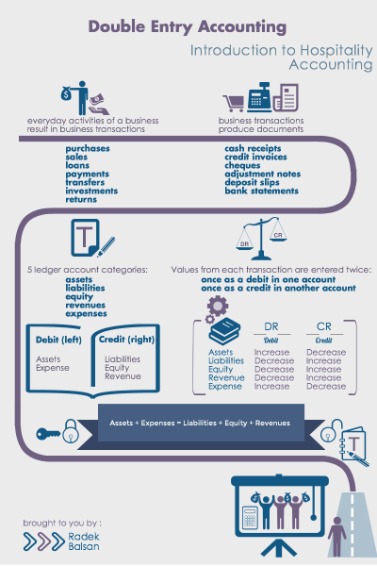

The profit and loss statement shows how profitable your business is and how much you are making over a period of time. The balance sheet shows you the financial position as it throws light on the assets, liabilities, and equity. An outsourced bookkeeping service often includes bank reconciliation. This process involves reconciling your business bookkeeping records with those on the bank statement or your business bank account. Bank reconciliation is crucial for every business because it protects you from fraud, lets you balance your records, makes it easy during audits, and spots discrepancies.

Firms with global operations

All outsourcing companies have unique qualities but differ in many ways. It’s best to create a pros and cons list of companies when outsourcing bookkeeping so you’ll know you’ve made the best choice. When you go for a bookkeeping firm, you get some additional assurances not provided by solo bookkeepers.

QuickBooks Live: Best for QuickBooks users

Yes, especially for small businesses needing flexible and personalized services. Consider outsourcing if you need to save time, reduce errors, and focus on your business growth. Their expertise allows for more precise and insightful financial statements, important for informed decision-making net sales defined and strategy development. This is especially helpful for business owners who often take on bookkeeping themselves.

Offshore bookkeeper companies are located in India and other countries, where it costs less to hire such service providers. This allows offshore bookkeepers to offer more affordable fees for bookkeeping. According to GrowthForce, outsourcing your bookkeeping will come with a price tag that spans anywhere from $500 to $2,500 per month. The main factors that will impact the cost are the number and complexity of services needed. That means cost will most likely scale with the size of business and financial accounts, so small businesses will pay less than enterprises for these services.

This blog is trying to simplify the complexities and stress its benefits so that readers are well-informed when they make any outsourcing decisions. Or, if it isn’t already included, you may be looking for tax support to take some of the pressure off when it’s time to file returns. These services can help you claim the correct small-business tax credits and deductions, prepare your returns and file them. Even if a bookkeeping service has all of these add-ons, they can be expensive, so be sure you understand the total cost before choosing a service.